Cook off the hook: Why the Fed wall stood tall

Supreme Court signals mortgage fraud pretext cannot override the Federal Reserve Act, affirming that the 14-year statutory term is a hard check on executive power.

The Supreme Court appears poised to reject the Trump administration’s bid to remove Federal Reserve Governor Lisa Cook, with a majority of justices, including key conservatives, signaling during oral arguments that the executive branch’s legal theory would fundamentally destabilize the nation’s central bank.

The decisive turn in Trump v. Cook came Wednesday when Justice Brett Kavanaugh warned Solicitor General Elizabeth Prelogar that the administration’s definition of cause for removal was so broad it could “shatter” the Federal Reserve’s statutory independence.

Following the hearing, legal analysts and bond market observers verified that the “for cause” standard established in the 1935 Humphrey’s Executor ruling remains the likely controlling precedent.

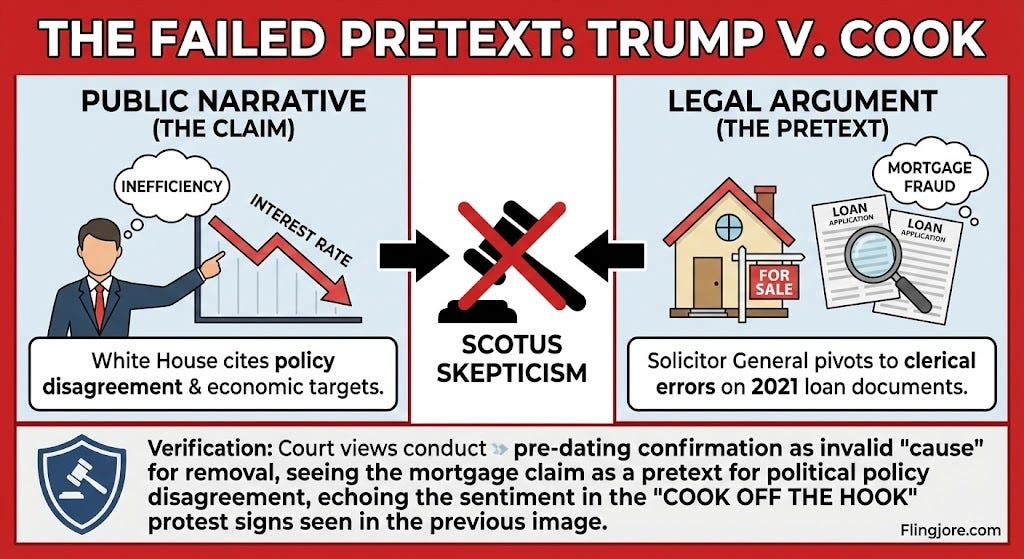

Problem of ‘pretext’

While the White House has publicly criticized Cook for “inefficiency” regarding interest rate policy, the Solicitor General’s arguments in court pivoted to a narrower, conduct-based claim: allegations of mortgage fraud pre-dating Cook’s appointment.

Flingjore.com’s review of the Office of Government Ethics filings confirms the administration’s argument centered on a clerical discrepancy regarding “primary residence” status on two loan applications filed in 2021.

However, the “pretext” strategy crumbled under questioning. Chief Justice John Roberts noted that the Senate had already exercised its “advice and consent” role by confirming Cook in 2022, effectively adjudicating her prior record.

”To allow the President to reach back before confirmation to find ‘cause’ is to render the Senate’s role moot,” Roberts said, according to the official argument transcript.

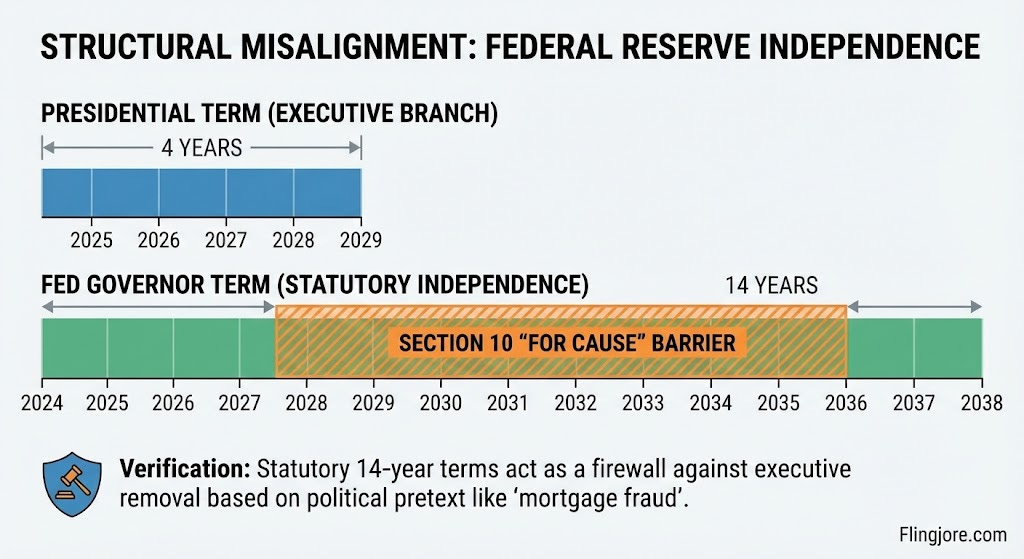

Verifying Section 10

The core of the dispute remains the structural integrity of the Federal Reserve Act.

Section 10 Verification:

The Statute: Congress mandates that members of the Board of Governors shall hold office for terms of 14 years.

The Intent: As verified by the Congressional Record of 1913, this duration was explicitly designed so that a governor’s term would outlast three presidential administrations, preventing any single president from packing the Board.

Justice Elena Kagan pressed this point, arguing that removing a governor for policy alignment—disguised as “inefficiency”—would transform the Fed into “a political arm of the Treasury.”

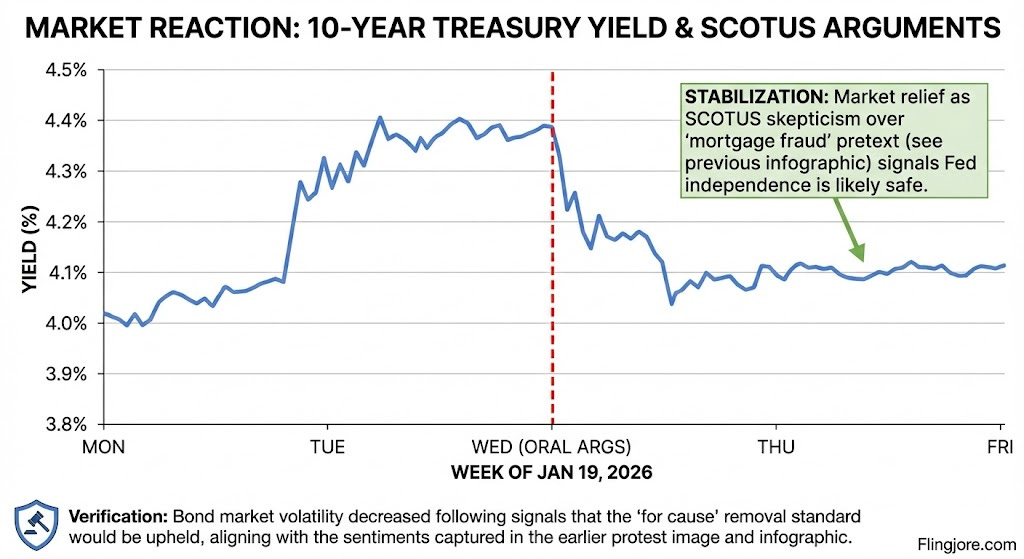

Market reaction

Financial markets reacted positively to the probable preservation of the status quo. The yield on the 10-year Treasury note stabilized Friday, correcting a week-long volatility spike that began when the Department of Justice filed its initial brief.

Analysts at Goldman Sachs noted in a Friday client memo that the “survival of the Section 10 barrier” is critical for maintaining foreign investment in U.S. debt.

What comes next

The Court is expected to issue its final opinion in June. However, the skepticism from the conservative bloc suggests a narrow ruling that will uphold Cook’s tenure while potentially tightening the definition of “inefficiency” for future administrative state cases.

Until then, Governor Cook remains a voting member of the Federal Open Market Committee.