U.S. didn’t invade Venezuela, Trump just took it private

Inside the hostile takeover of a distressed sovereign asset: New CEO installed, old management liquidated and the copper wiring stripped to bankroll the 250th anniversary.

The extraction of Venezuelan President Nicolás Maduro from Miraflores Palace by U.S. forces this weekend was presented to the world as a law enforcement action: a decisive strike against a narcoterrorist regime.

A comprehensive analysis of the Trump administration’s synchronized moves across the Department of Energy, the Department of Justice and the State Department reveal a far more complex reality.

The operation, codenamed Operation Absolute Resolve, was not merely a military raid; it was a geoeconomic restructuring. By dismantling the executive leadership of the Venezuelan state while preserving its bureaucratic machinery, and by seizing direct administrative control over the nation’s oil revenue, the United States has operationalized a new foreign policy: Resource Receivership.

This resource receivership marks a definitive break from the nation-building efforts of the post-9/11 era. Under this new model, the objective is not to export democratic institutions or stabilize civil society for its own sake. The goal instead is to place a distressed sovereign asset into a form of international conservatorship, installing compliant management to secure specific commodities and geopolitical leverage.

Disparate elements of the last 72 hours connect the mechanics of a hostile takeover the installation of Delcy Rodríguez, the seizure of crude stockpiles, the silence of the Kremlin and the revisionist history regarding the 2020 election.

Liquidation of legacy management

The removal of Nicolás Maduro is best understood not as a coup d’état, but as a liquidation of entrenched management that had become a liability to the asset’s value.

For years, U.S. policy was paralyzed by a binary choice: tolerate a hostile socialist dictatorship or risk the chaos of a total government collapse that would destabilize the regional energy market. The “Receivership” model navigated a third path.

The most telling indicator of the administration’s intent was the immediate sidelining of the Venezuelan democratic opposition.

U.S. policy explicitly supported the democratic coalition for decades, most recently led by María Corina Machado, who won the opposition primaries by a landslide and maintains broad popular legitimacy.

In a traditional liberation scenario, power would have been transferred to Machado or a transitional council of opposition figures. Instead, the White House recognized Vice President Delcy Rodríguez as the interim head of state.

Rodríguez’s elevation confirms that the U.S. prioritized continuity over democracy. To administration strategists, Rodríguez represents a pragmatic technocrat capable of keeping the state apparatus functioning.

Unlike the ideological hardliners in the Chavista movement, Rodríguez has a documented history of transactional behavior. Her authorization of a $500,000 donation from Citgo to the 2017 Trump inauguration demonstrated an early understanding that the regime’s survival depended on financial accommodation with the United States.

By retaining Rodríguez, the U.S. avoids the “de-Baathification” error of the Iraq War.

The Venezuelan military, the police forces, and the state oil company (PDVSA) bureaucracy remain intact, reporting to a manager who now owes her position entirely to U.S. forbearance.

The only task is to maintain internal order and suppress dissent, effectively outsourcing the costs of occupation to the local security apparatus while the U.S. retains veto power over strategic decisions.

Despite publicly describing the U.S. action as a “stain on our relations,” Rodríguez has committed to an “agenda of cooperation,” signaling her acceptance of the new hierarchy.

Asset seizure and financial control

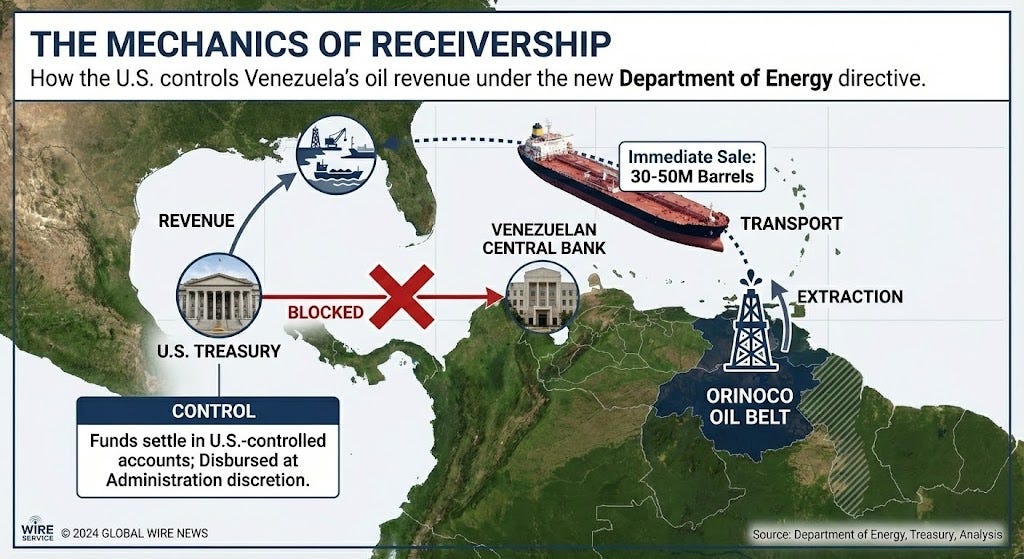

If Rodríguez is the CEO, the U.S. Treasury is the Board of Directors. The terms of this arrangement were detailed in a Department of Energy outline released Wednesday, which fundamentally alters the sovereignty of Venezuela’s economy.

The policy directive authorizes the indefinite sale of Venezuelan oil to global markets, beginning with an immediate tranche of 30 million to 50 million barrels. This volume is significant enough to impact global futures markets, but the mechanism of the sale is the crucial detail.

The directive specifies that proceeds will settle in “U.S. controlled accounts” at globally recognized banks, to be disbursed at the “discretion” of the Trump administration. This clause effectively strips the Venezuelan state of its fiscal autonomy. Caracas can no longer independently collect revenue from its primary natural resource. This financial structure accomplishes three strategic objectives:

First, it renders Venezuela’s obligations to other creditors, specifically China, unenforceable. Beijing has loaned billions to Venezuela, backed by oil shipments. With the U.S. controlling the physical flow of oil and the financial flow of revenue, China’s lien on Venezuelan assets is effectively voided. Beijing must now negotiate with Washington, not Caracas, for repayment.

Second, the administration gains the ability to flood the market with heavy crude, which is chemically optimized for U.S. Gulf Coast refineries. This supply injection is timed to depress domestic gasoline prices ahead of the summer driving season and the 2026 midterm elections, providing a tangible economic benefit to the American electorate.

Third, the discretionary nature of the funds creates an off-the-books revenue stream. Analysts suggest these funds could be directed toward projects that lack Congressional appropriations, such as the Golden Dome missile defense system, which the President has pledged to build.

By funding national security projects with foreign asset seizures, the administration bypasses the legislative “power of the purse.”

Narrative asset and historical revisionism

The Receivership doctrine extends beyond physical commodities to political narratives. The capture of Maduro provides the administration with a unique asset to deploy in the ongoing culture war regarding the 2020 election.

With Maduro in U.S. custody facing life imprisonment, the Department of Justice possesses total leverage. Intelligence sources indicate that debriefings are focusing on election integrity alongside narco-terrorism.

For five years, a segment of the American electorate has believed that Venezuelan-linked software (Smartmatic) was utilized to alter vote counts in the 2020 election.

These claims were rejected by every court that heard them, and Smartmatic has repeatedly debunked them, citing a lack of any physical presence in the 2020 U.S. election. However, a “confession” from the deposed Venezuelan leader—secured through plea negotiations—would serve to validate these claims in the public sphere regardless of factual merit.

The potential for such a confession aligns with recent domestic moves. On the fifth anniversary of January 6, the White House website was updated to reframe the events of that day, shifting blame to Capitol Police and labeling rioters as “innocent.”

This revisionist history, bolstered by 1,600 pardons, creates a fertile environment for a new “revelation.”

If the administration produces testimony from Maduro admitting to interference, it moves the “Stolen Election” narrative from the realm of conspiracy theory to the status of national security intelligence.

Providing a retroactive justification for the actions of the administration and its supporters helps secure the President’s historical legacy as the nation approaches its 250th anniversary.

Geopolitical realignment

The geopolitical context of the raid suggests a broader realignment of Great Power relations, specifically a transactional détente with the Russian Federation.

Russia has been the primary guarantor of the Maduro regime’s survival, providing military advisors, mercenaries, and financial lifelines. Yet, the Russian response to the U.S. operation has been notably passive. This week, U.S. forces seized the Russian-flagged oil tanker Marinera in the North Atlantic, eliciting no military counter-move from Moscow.

This acquiescence supports reports from former administration advisers of a “Caracas for Kyiv” understanding. In this framework, the U.S. signals a reduction in support for Ukraine and a tacit acceptance of Russian influence in the Donbas region.

In exchange, Russia withdraws its security guarantee from Venezuela, allowing the U.S. to reassert hegemony in the Western Hemisphere. This trade represents a shift from values-based diplomacy to spheres-of-influence realism. It acknowledges a multipolar world where superpowers respect each other’s regional dominance in exchange for stability.

The loser in this equation is the concept of international law, which is replaced by bilateral deal-making.

Donroe Doctrine

President Trump has characterized this aggressive posture as an update to the 1823 Monroe Doctrine, which warned European powers against interfering in the Americas.

In what observers are calling the Donroe Doctrine, the administration asserts not just a protective role over the hemisphere, but a proprietary one.

“The Monroe Doctrine is a big deal. But we’ve superseded it by a lot,” Trump said following the raid.

This corollary effectively claims U.S. ownership of regional resources when deemed necessary for national security or economic stability.

The invasion of Venezuela is a defining moment for the modern American presidency. It demonstrates a capability and willingness to use military force not just for defense, but for corporate restructuring.

By placing Venezuela into receivership, the administration has secured a supply chain for U.S. energy needs, neutralized a geopolitical rival in the hemisphere, and acquired a political asset to deploy in domestic disputes.

The Resource Receivership doctrine posits that the sovereignty of a nation is conditional on its management’s efficiency and its alignment with U.S. interests. Under this new ruleset, Venezuela is no longer a crisis to be solved; it is a holding to be managed..